26+ how to pay mortgage early

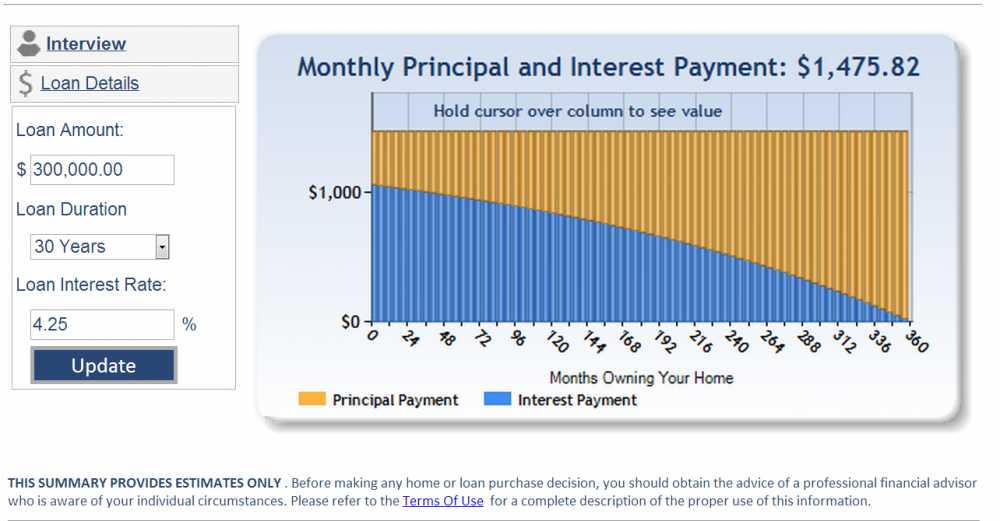

Ad Compare the Best Reverse Mortgage Lenders. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

4 Simple Ways To Pay Off Your Mortgage Early Seedtime

RefinanceOr Pretend You Did.

. This way you end up paying 26 payments or the equivalent of 13 months. Web 5 ways to pay off your mortgage early 1. I havent done the math on what that would mean for a payoff but it would accelerate it considerably.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Lock In Your Rate Today. The extra 1000 per month would represent close to a double payment per month.

In other words one extra payment every year. Web A potentially simpler way for homeowners to pay off their homes quicker and save on interest charges is by making extra payments. Refinancing your mortgage to pay it off early only makes sense if you can get a lower.

Figure out when you plan to retire and divide your debt amount by the number of working years you have left. With 26 payments of 89938 youll be able to take off a few years from your mortgage AND save almost 71000 in interest payments. For Homeowners Age 61.

This entails paying half of the regular mortgage payment every two weeks. You can add in the extra payment whenever you want throughout the year and continue to make those regular monthly payments as well. Web For example paying 10 more each month allows Lena to pay off her mortgage in 26 years and save 22590 in interest expense.

Web Mortgage Payoff. There is a little over 15 years remaining on a 20-year note. Pay a little more each month One surefire way to pay off your loan sooner and pay less interest is to increase what you.

Web Make One Extra Payment Per Year. Lets see how this would impact our earlier. Web Here are Ramseys tips for how to pay off your mortgage early.

Consult with your lender or mortgage servicer to make sure theyll accept bi-weekly payments. One way of paying off your mortgage earlier than the term of your mortgage is to make 13 payments per year instead of 12. You can pay off your balance faster if you round those payments up to 1480less than 4 extra per monthor even up to 1500 and you likely wont miss the money.

Web Consider if investing might be a smarter financial decision than paying your mortgage off early. Web One easy way to pay off your mortgage sooner is to pay your loan on a biweekly basis instead of monthly. Namely the extra money used to pay down the mortgage cannot be used for other opportunities.

Web The average homeowner makes their mortgage payment once a month. You can pay off your mortgage loan faster if you add an extra monthly payment each year. Make an Extra House Payment Each Quarter.

Web Youll pay half the monthly amount every two weeks which equates to 26 half payments or 13 full payments. Web There are many advantages to paying off a mortgage early reasons include reducing debt increasing cash flow and having complete ownership of your home. Mortgage payments are usually an amount to the penny like 147682 a month.

Get A Free Information Kit. Web Based on our example youll pay your mortgage off a year early saving over 6000 in the process. Web The idea is to divide your monthly payment in half and pay that amount every two weeks.

When you throw extra money at your monthly mortgage payment more of each payment. Compare Offers from Americas Top Banks Mortgage Lenders. The first way is to split your monthly mortgage payment in half and make biweekly payments.

1 Opportunity Cost and Taxes Paying a mortgage off early comes with a cost. Another way to pay off your mortgage early is to trade it in for a better loan with a lower interest rate and a shorter termlike a 15-year fixed-rate mortgage. However if you actually get your.

Use a savings account. For example if your monthly mortgage payment is 1000 youd pay 500 every 2 weeks instead of 1000 at the end of the month. Meanwhile there are 52 weeks in a year.

Divide your monthly principal payment by 12 then add that amount to each monthly payment. There are three primary methods for making extra payments pay. Make lump-sum payments.

Remaining mortgage debt 150000 25 year term Interest rate of 5 100 per. To answer the original question should you pay off your mortgage early. Web Below are some examples based on different overpayments that you might make towards repaying your mortgage early.

Ad Rates Are On The Rise. With bi-weekly payments you pay half your monthly payment every two weeks. That means one extra payment a year which reduces the life of your monthly mortgage payments and helps you pay off a mortgage early.

One of the most effective ways to pay off your mortgage faster is to pay more than the monthly amount due. Thus borrowers make the equivalent of 13 full monthly payments at years end or one extra month of payments every year. I was adding to my mortgage payment by about 1000 a month to pay it off in seven years instead of 14 years.

31 and count it toward your tax deductions. Refinance to a Shorter. You end up making the equivalent of 13.

With 52 weeks in a year this approach results in 26 half payments. Web Round Your Balance Up. How Much Interest Can You Save By Increasing Your Mortgage Payment.

NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web How to pay off a mortgage early. Use the 112 rule.

For Homeowners Age 61. Web My best advice is to pay off your mortgage by the time you no longer want to work. First National Bank of Ramit.

Thats like 18000 lattes or one every day for the next 50 years. For instance if your monthly payment is 1200 your biweekly payment will be 600. Web Over 30 years youll end up paying 34751457 in interest.

Web Another strategy for paying off the mortgage earlier involves biweekly payments. Complete Ownership One of the biggest benefits of paying off a mortgage early is having complete ownership of your home. Ive refinanced at 2375 and can get a certificate of deposit CD for a year at 4.

Web Here are three solid strategies to pay off your mortgage early. Deposit one-twelfth of the monthly principal payment into a savings account each month. Web Based on the figures which have been entered into our Mortgage Early Repayment Calculator.

Web Ive been debating whether to pay off my mortgage. Thats 12 payments per year. On a regular monthly plan borrowers only make 12 payments a year.

Web Here are the five best ways to pay off your mortgage faster with the numbers to prove it. Web Some tax professionals say you can simply make your extra mortgage payment late this month with a check dated Dec. If you continuously pay an amount of 80000 on a monthly basis then you will be able to repay your mortgage off in 21 months quicker than if you paid the regular monthly installment of 50000.

Create Room in Your Budget.

Scientific Bulletin

11 Easy Ways To Pay Off Your Mortgage Early Moneysmartguides Com

Use These Tips To Pay Off Your Mortgage Early

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

26 Sample Lending Agreement In Pdf

How To Pay Off Your Mortgage Early

Should I Pay Off My Mortgage Early Saverocity Finance

Best 20 Loan Amortization Schedule Templates Excel Free Best Collections

How To Pay Off Your Mortgage Early The Ascent

10 Hacks To Pay Your Mortgage Off Early Youtube

How To Pay Off Mortgage Early Uk Youtube

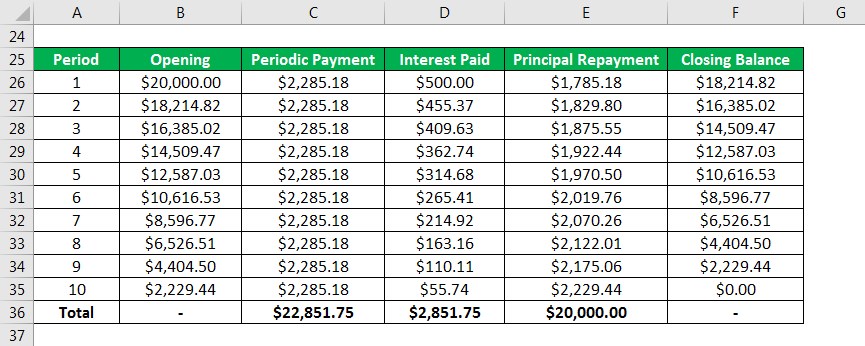

Amortized Loan Formula Calculator Example With Excel Template

3 Powerful Strategies To Pay Off Your Mortgage Early

:max_bytes(150000):strip_icc()/sick-of-mortgage-payments-pay-off-your-home-early-453826_Final-201fc508b83c4f839d73a7a8bb4d1098.png)

How To Pay Off Your Mortgage Early

3 Powerful Strategies To Pay Off Your Mortgage Early

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

How To Pay Off Your Mortgage Early The 5 Best Ways In 2022